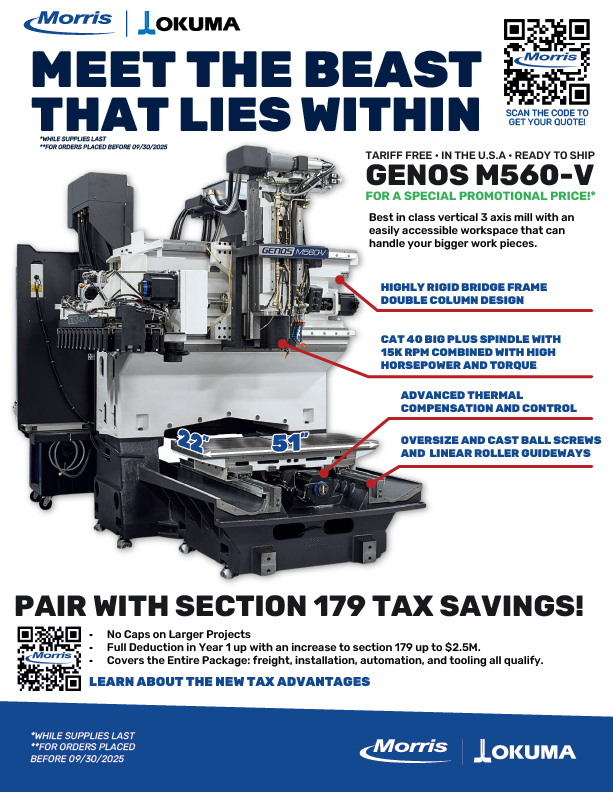

GENOS M560-V: High Performance Machining

The Okuma GENOS M560-V Vertical Machining Center is in stock and ready to boost your production. Designed for shops that demand power, precision, and consistency, it excels in high-mix, low-volume jobs and thrives under heavy-duty cutting conditions.

Act now to request more info! P.O must be submitted by September 30, 2025.

Please fill out the form below and we will get back to you.

Pair with Section 179 Tax Savings

You can write off up to $2.5 million in qualifying equipment purchases through Section 179 in 2025. This includes machines, tooling, software, and shop upgrades, all deducted immediately in the same tax year*

What's New for 2025

| Key Detail | 2024 | 2025 |

| Maximum Section 179 Deduction | $1,220,000 | $2,500,000 |

| Phase Out Starts At | $3,050,000 | $4,000,000 |

| Bonus Depreciation | 60% | 100% through 2032 |

Why It Matters to Your Shop

- Full Deduction in Year 1 — Expense up to $2.5M of qualifying equipment (new or used) the moment it’s placed in service.

- No Caps on Larger Projects — After the Section 179 limit, 100% bonus depreciation eliminates tax on every additional dollar—no ceiling, no waiting.

- Covers the Entire Package — Freight, installation, automation, and tooling all qualify.

- Flexible Election — Claim Section 179 or defer it; your controller keeps full control of the timing.

*MFR is not a qualified tax advisor. This worksheet must not be interpreted as either a a legal opinion or a tax advisory. You should always consult with your accountant prior to making any purchase based on tax consequences.

What Sets the GENOS M560-V Apart?

Cut with Confidence:

15,000 RPM CAT 40 spindle with 30 HP and 147 ft/lbs of torque handles tough materials with ease.

Hold Tight Tolerances:

Thermal Active Stabilizer and rigid double-column construction maintain precision—no chasing offsets.

Maximize Uptime:

32-tool ATC and seamless integration with automation reduce cycle times and keep the spindle turning.

Handle Bigger Jobs:

Large work envelope (41.34" X / 22.05" Y) supports high-mix, low-volume, and oversized parts.

Lower Energy Costs:

ECO Suite reduces power usage by up to 60% without compromising performance.

Integrate with Ease:

Okuma’s open-architecture OSP control simplifies automation, probing, and CAM workflows.

Protect Your Investment:

Industry-leading warranty: 2 years on parts, 5 years on control—plus peace of mind from Morris.